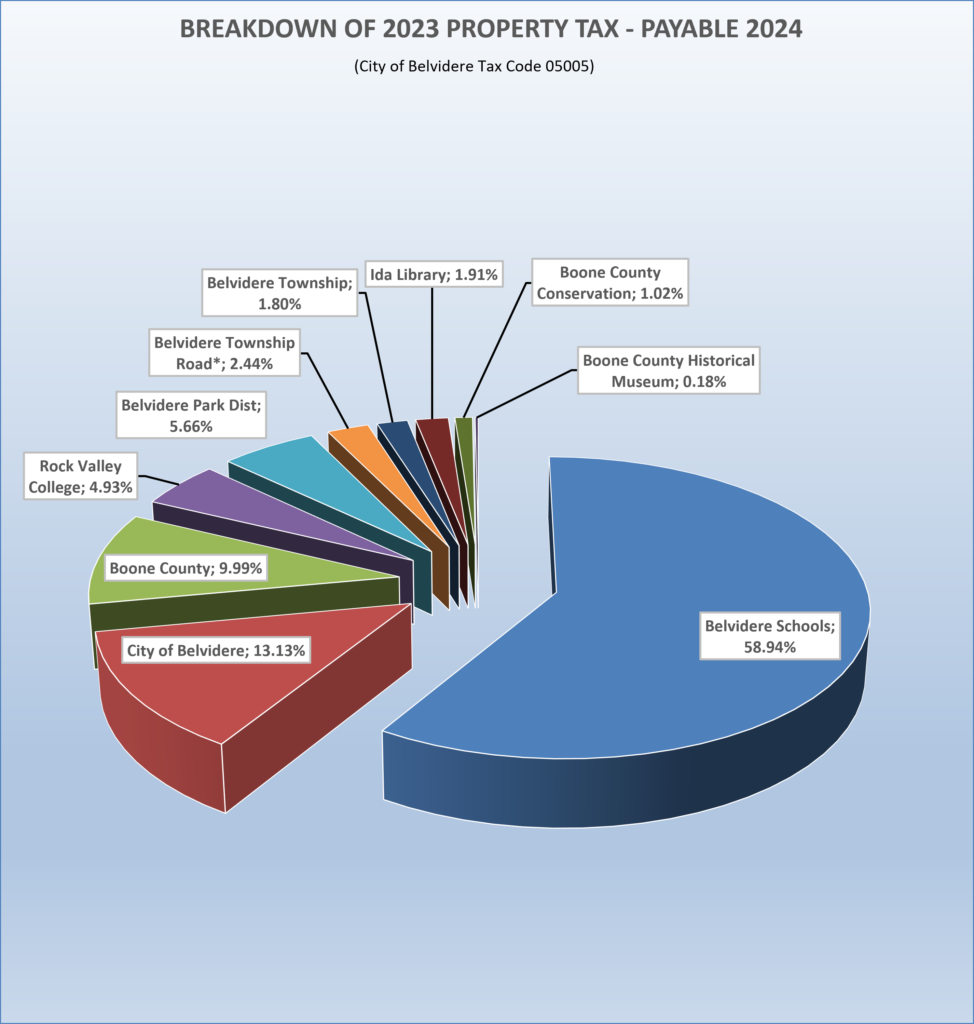

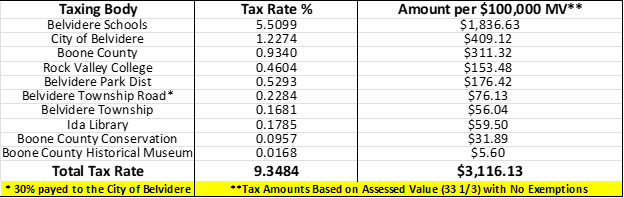

HOW YOUR PROPERTY TAX DOLLARS ARE DISTRIBUTED

This example is for property owners in Belvidere Township within the City of Belvidere tax district 05005

Belvidere Township 4.8 % of tax bill (CITY) (2023 payable 2024)

Belvidere Township Road and Bridge 0.2284

Belvidere Township 0.1681

Example: (red indicates amount to Belvidere Township)

$75,000 mv /3 = $25,000 av

$25,000 – $6,000 owner occupied exemption

$21,000 X .0043711= $91.79 **

$100,000mv /3 = $33,333av

$33,333- $6,000 owner occupied exemption

$27,333 X .0043711 = $119.48 **

$150,000mv /3 = $50,000av

$50,000- $6,000 owner occupied exemption

$44,000 X .0043711 = $192.33**

$200,000mv /3 = $66,666av

$66,666- $6,000 owner occupied exemption

$60,666 X .0043711 = $265.18**

** Amount would be less if property qualifies for Senior homestead exemption, Senior freeze or other qualifying exemptions **