Property Tax Breakdown 2022 – Payable 2023

The Tax Formula – How It is Determined

The Assessor is mandated by the State of Illinois to assess your property at 1/3 of its fair market value. This assessed amount, minus any applicable exemptions, is then used to determine the total property tax for a property.

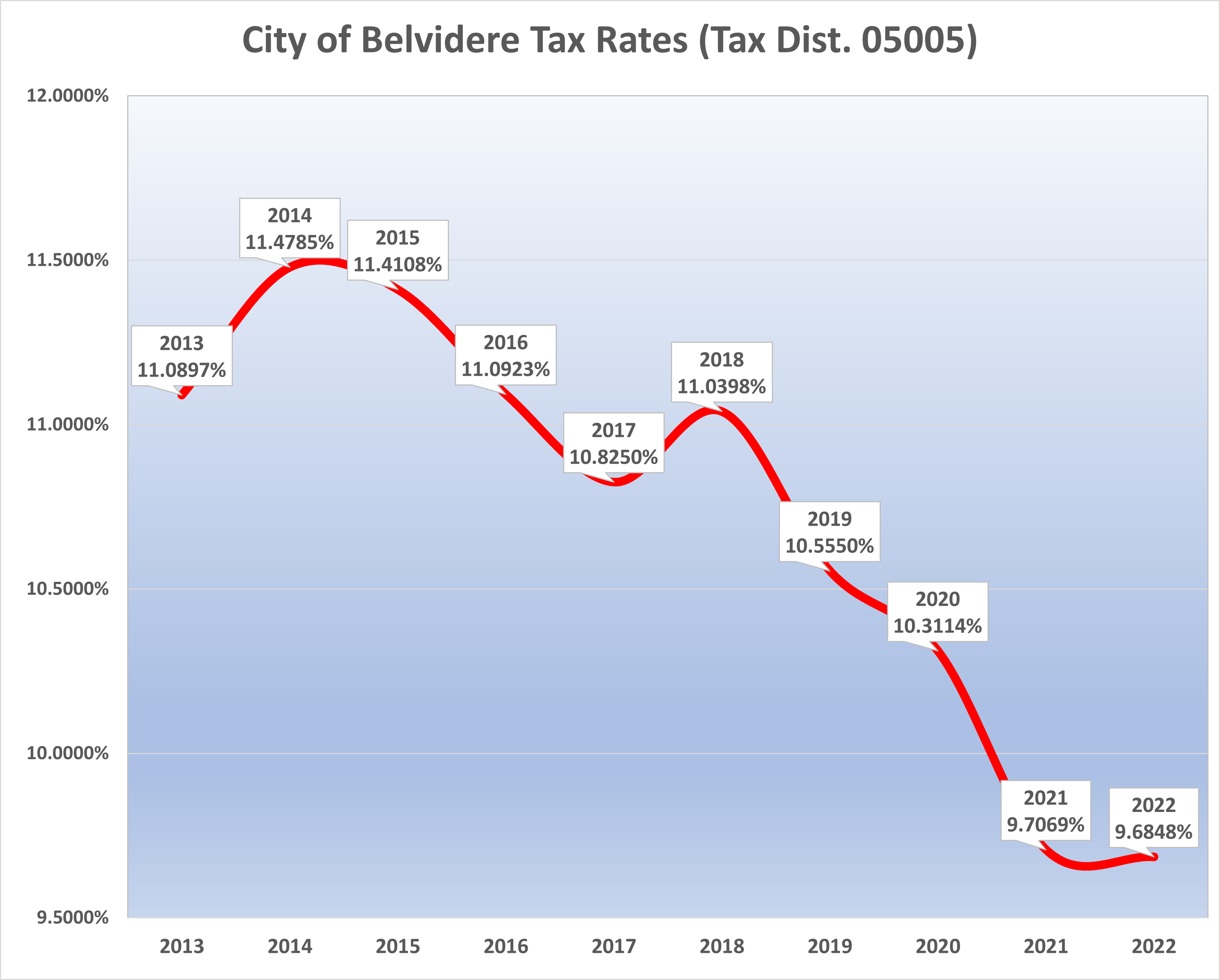

The total tax rate is the sum of the individual tax rates for the local taxing bodies in your area. These include your school district, park district, city and or county, etc. These taxing bodies use property tax revenues to pay for the services they provide in their districts. Local public school districts typically receive the largest portion of your property tax dollars. (See List Below)

Make your thoughts and feelings known regarding local property tax rates and how your tax dollars are being spent. Attend meetings held by the local taxing districts to voice your opinion or call them at the numbers provided below and let the local officials know how you feel.

Information Regarding Property Taxes From Assessor Mike St. Angel

The purpose of property taxes is to support local government and services that function to maintain a decent quality of life in our community. All of the tax dollars collected through the property tax stay in our local community and pay for those services. Illinois state legislature has determined that the property tax burden be spread evenly among all the taxpayers based on the assessed value of the property that they own. The primary responsibility of the Assessor’s Office is to discover, list and value all property as accurately, fairly and equitably as possible. The Township Assessor must comply with Illinois State law to uniformly assess properties at 1/3 of market value (assessed value); furthermore, the Township Assessor applies specific mass appraisal techniques when necessary to the valuation process to assure that property is assessed as equitably as possible.